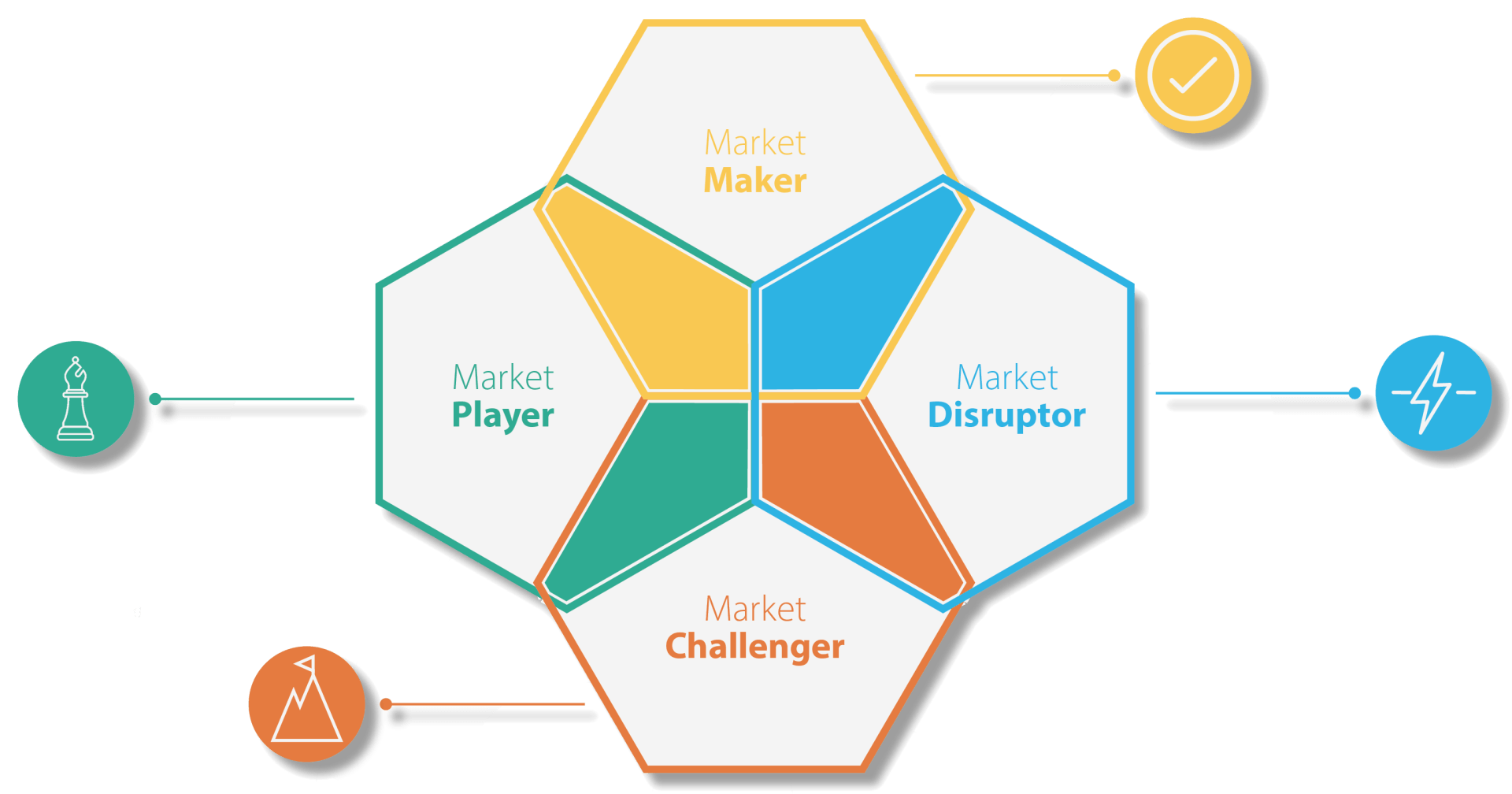

1. Market Challenger

As a market challenger, there are three areas you should focus on to maximize benefit: your strategy, your strengths and your history.

At the challenger stage, you’re the new kid on the block. Consumers and competitors alike will look at your company with a lot of skepticism. At this point, your best option is to lead with a well thought out strategy and vision, which provides your team with a clear sense of direction.

Another key element to overcoming the challenger stage is by playing to your strengths. By showing customers that your company thrives on a certain area of expertise, you make yourself more credible within the market.

Finally, you should highlight your history as a company. By showing your record of performance, you demonstrate in a concrete way why you deserve to be in the business—why you should stay.

Expectation: Enter, adjust course & become deliberate with Strategic Intent

Customer Perception: Skepticism

Lead with: Vision & Strategy

Behaviour/Culture: Agility, listen

2. Market Player

Before anything else, the only way you can truly become a market player is if you have a sufficient number of offerings to satisfy a sizeable share of the target market. Now that you’ve asserted yourself as a market player, you have the confidence, money and heft to create the room for investment and come up with a type of market disruption.

And it’s not that you haven’t been thinking about becoming a disruptor since the beginning, but you have now earned your way into the disruptive stage.

Expectation: Expand offerings to satisfy the market

Customer Perception: Acceptance

Lead with: Flawless execution

Behaviour/Culture: Dissatisfaction with status quo

3. Market Disruptor

Once you become a market player, you need to make the move to becoming a disruptor. This occurs when you develop a new technology, product or process that contributes to customer satisfaction and separates you from the competition.

There is a constant tension between future growth and stagnation that you must be wary of at this stage. If you do not take advantage of your status as a market disruptor, you run the risk of reverting back to a market challenger.

Expectation: Introduce technology as a key differentiator

Customer Perception: Delight

Lead with: Hyper innovation

Behaviour/Culture: Agility, listen

4. Market Maker

Once you’ve introduced a disruption that gains traction in the market, you earn the right to be a market maker. As a market maker, you become a leading voice in your industry. You understand how the consumer thinks, and you are ahead of the pack when it comes to determining where the market is going to move to next.

Expectation: Establish as a category thought leader

Customer Perception: Trust

Lead with: Thought leadership

Behaviour/Culture: Dissatisfaction with the status quo

Here’s the kicker. When you feel like your company has arrived at a suitable place in the market, it has not. During the Market Player and Market Maker stages, you have to be resolute in not being satisfied with the status quo. If you don’t pivot to becoming a disruptor—if you don’t invest in innovation with a sense of urgency—there is a high chance that you will slip back into being a Market Challenger.

New Paragraph

All Rights Reserved | Spyder Works Inc